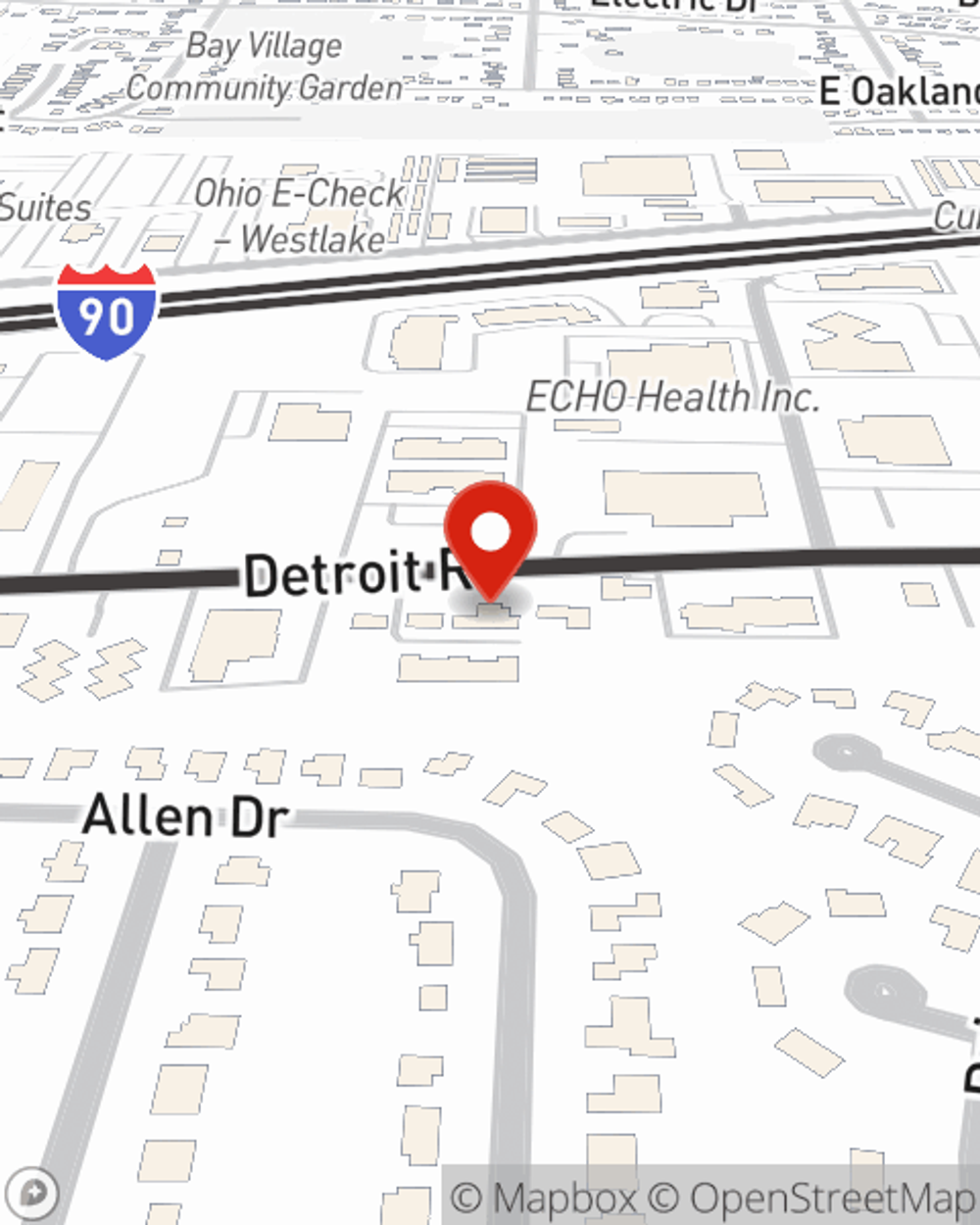

Business Insurance in and around Westlake

Westlake! Look no further for small business insurance.

No funny business here

Help Protect Your Business With State Farm.

The unexpected happens. It's always better to be prepared for the unfortunate problem, like an employee getting injured on your business's property.

Westlake! Look no further for small business insurance.

No funny business here

Insurance Designed For Small Business

The unexpected is, well, unexpected, but that doesn't mean you shouldn't be prepared. State Farm has a wide range of coverages, like errors and omissions liability or a surety or fidelity bond, that can be formed to develop a customized policy to fit your small business's needs. And when the unexpected does happen, agent Candice Stryker-Irlbacher can also help you file your claim.

Take the next step of preparation and call or email State Farm agent Candice Stryker-Irlbacher's team. They're happy to help you explore the options that may be right for you and your small business!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Candice Stryker-Irlbacher

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.